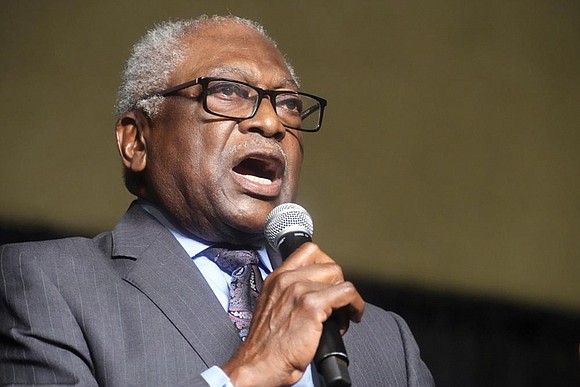

U.S. failed to stop fraud in COVID loan program, Clyburn says

Associated Press | 6/16/2022, 6 p.m.

The U.S. failed to take basic steps at the start of the coronavirus pandemic to prevent fraud in a federal aid program intended to help small businesses, depleting the funds and making people more vulnerable to identity theft, the chairman of a House panel examining the payouts said Tuesday.

Democratic Rep. James Clyburn blamed the Trump administration for the problems in the COVID-19 Economic Injury Disaster Loan program, overseen by the U.S. Small BusinessAdministration,amid revelations that as much as 20 percent of the money — tens of billions of dollars — may have been awarded to fraudsters.

Mr. Clyburn said the Biden administration has implemented measures to identify potential fraud and directed loan officers to address indications of fraud before approving loans, while Congress has invested in fraud prevention and accountability.

Rep. Steve Scalise, the No. 2 House Republican, said the Trump administration and Congress worked together at the beginning of the pandemic, when uncertainty was rampant and much of the economy was locked down, to deliver “much needed relief as fast as we could to help save as many jobs as we could” and prevent the economy from crashing.

Mr. Scalise, R-La., said Democrats are undermining the successes, and he asked why the House coronavirus panel Mr. Clyburn chairs wasn’t looking into the enhanced unemployment insurance program that was plagued by “egregious and unprecedented fraud” and is a “leading contributor” to the high inflation rates.

“I hope that in our oversight of pandemic programs, my Democratic colleagues will be able to recognize the difference between what was needed to save the economy during an unprecedented pandemic versus pushing a partisan, inflation- inducing agenda,” he said.

Mr. Clyburn, of South Carolina, said the subcommittee will determine what more must be done to bring perpetrators of fraud to justice and how to protect future emergency programs.

Mr. Clyburn said he supports extending the statute of limitations for this kind of fraud case to give investigators more time to untangle complex potential crimes. Witnesses at the hearing suggested standardizing the data collected by states to make it easier for federal authorities to spot possibly fraudulent patterns.

The SBA’s Office of the Inspector General has estimated that at least $80 billion distributed from the $400 billion EIDL program could have been fraudulent, much of it in scams

using stolen identities. Separately, staff for the select subcommittee on Tuesday issued a report that found that some 1.6 million applications for the loans may have been approved without being evaluated.

Fraud overwhelmed enhanced unemployment insurance programs funded by the federal government and ad- ministered by the states. There was so much aid to governments that many struggled to find a way to spend it all under the original regulations. And there have been questions about whether the Paycheck Protection Program to keep employees working was worth it.

The Secret Service said in December that nearly $100 billion has been stolen from COVID-19 relief programs, basing that estimate on its cases and data from the Labor Depart- ment and the Small Business Administration.